January 10, 2024

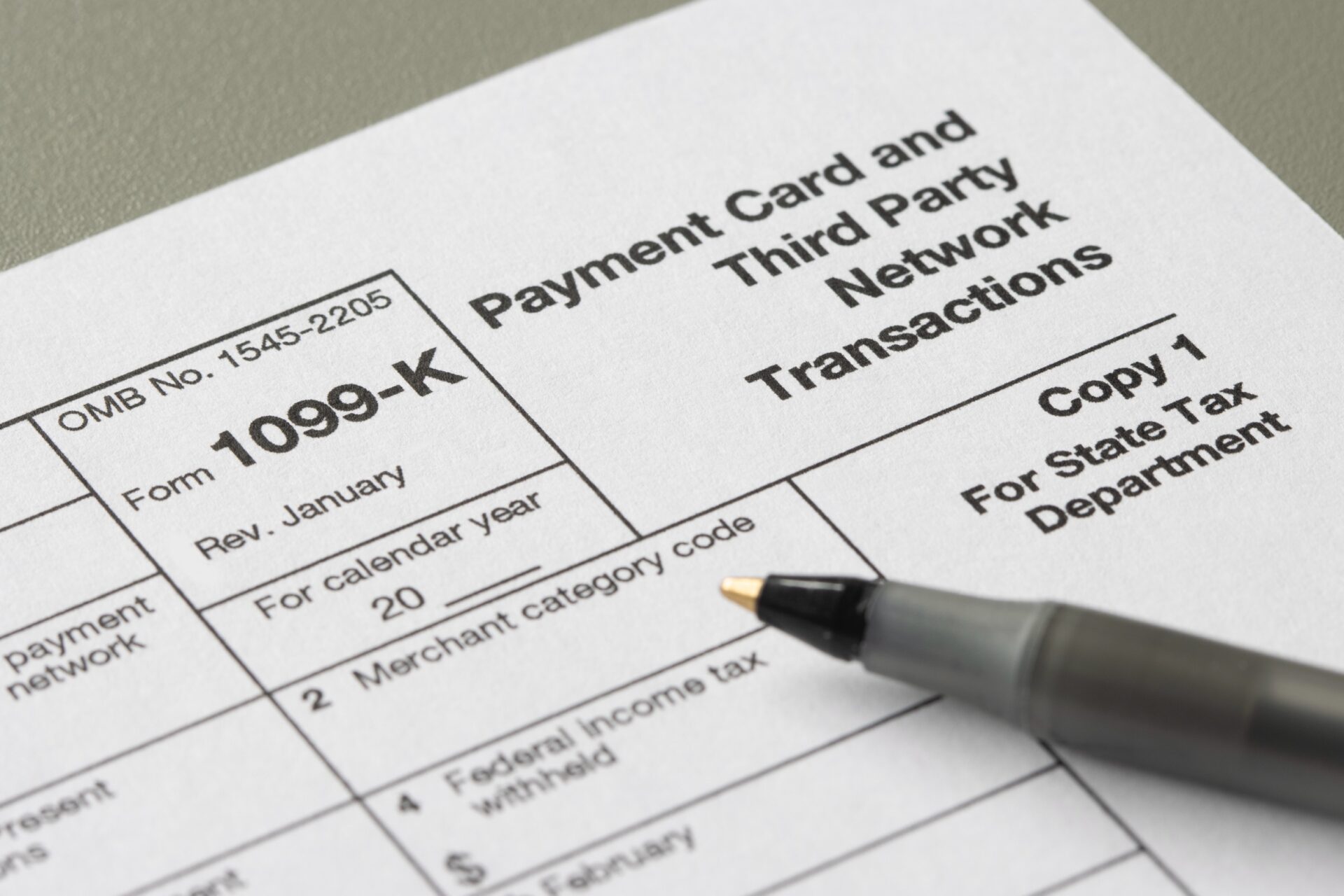

IRS Will Enforce 1099-K Reporting Of Cash App, Venmo, Zelle, And PayPal Transactions

In 2024, the IRS is set to enforce the long-anticipated 1099-K reporting requirement for third-party payment apps.

In 2024, the IRS is set to enforce the long-anticipated 1099-K reporting requirement for third-party payment apps, such as PayPal, Venmo, Cash App, or Zelle. Initially slated for 2022, this rule mandates reporting earnings over $600 to the IRS; however, reporting will apply only to income exceeding $5,000 for the upcoming year. According to CNET, the IRS aims to streamline income reporting to ensure more accurate financial disclosures from freelancers and business owners.

This tax reporting shift has experienced delays in allowing payment apps to navigate complexities in distinguishing taxable and non-taxable transactions. This year’s phased rollout requires payment apps to report earnings exceeding $5,000, offering a transitional period to reach the eventual $600 threshold.

For freelancers, the evolving landscape introduces uncertainties regarding tax expectations for the upcoming season. While the reporting requirement was deferred for 2023, freelancers must continue reporting earnings. The impact of this change on 2024 tax returns is noteworthy, with the IRS potentially revisiting the threshold or further delaying the rule.

Popular payment apps like PayPal, Venmo, Zelle, and Cash App will be subject to this IRS rule, necessitating freelancers to consider maintaining separate accounts for professional transactions. Importantly, the IRS clarifies that personal transactions, like gifts or reimbursements from family and friends, remain non-taxable.

For individuals selling personal items via third-party payment apps, transactions below the purchase cost are exempt from taxes. However, those running side hustles with profits exceeding $5,000 are subject to taxation.

As the reporting change looms, payment app users are encouraged to confirm tax information, such as an employer identification number or Social Security number. While the 1099-K simplifies filing for self-employed individuals, maintaining accurate records remains crucial. Freelancers with multiple clients are advised to track earnings systematically, manually, or through accounting software, ensuring a smooth transition into this new tax reporting landscape.

RELATED CONTENT: IRS Set To Rollout Free File Tax Return Pilot In January