February 8, 2024

Justice Department, North Carolina Reach $13.5M Settlement With Bank Over Redlining Claims

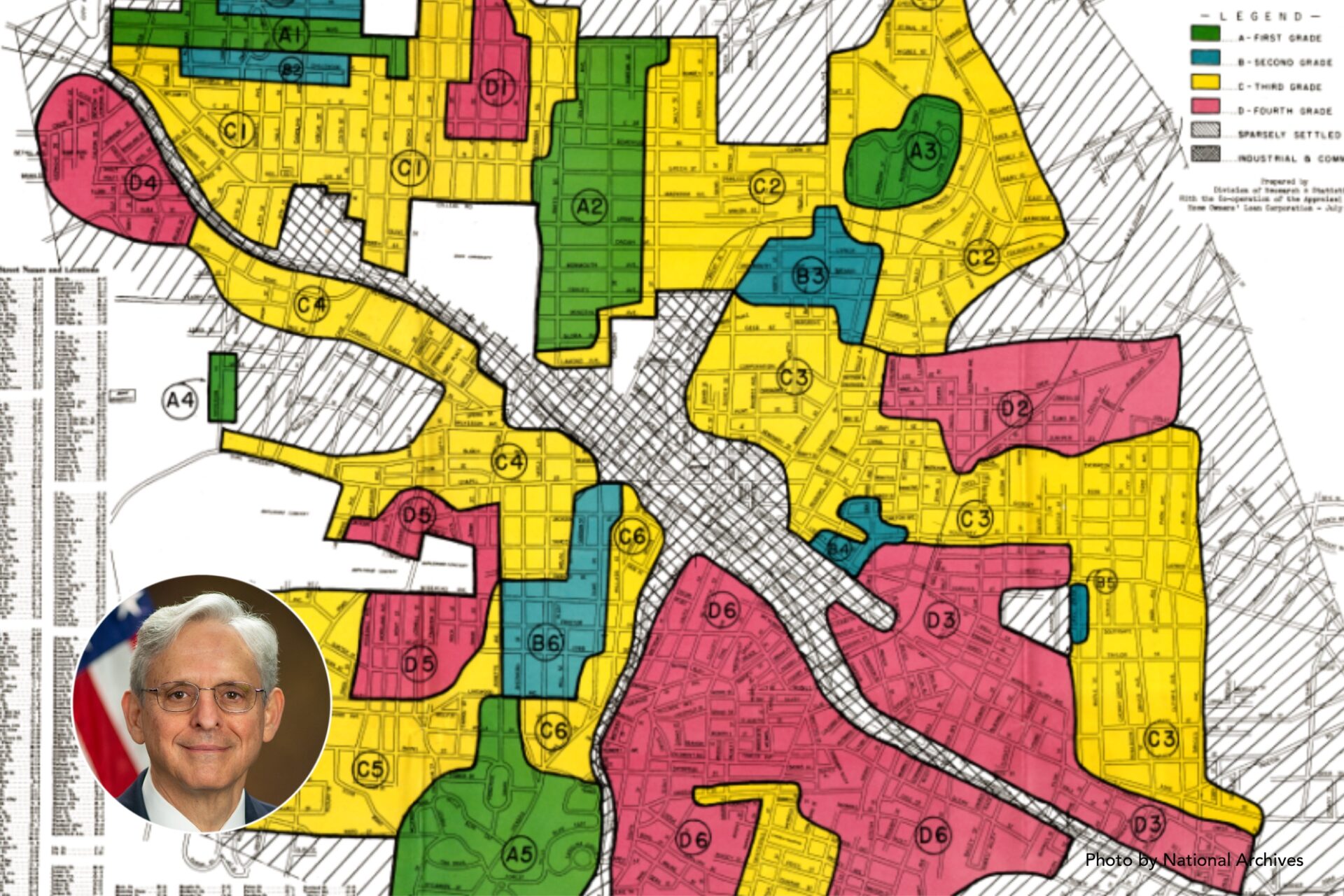

The Justice Department and the state of North Carolina reached a $13.5 million settlement with a bank to resolve allegations of redlining

The Justice Department and the State of North Carolina reached a $13.5 million settlement with the First National Bank of Pennsylvania (FNB) to resolve allegations that it engaged in redlining in predominantly Black and Hispanic neighborhoods in Charlotte and Winston-Salem.

“Lending discrimination violates the law and harms communities and entire families for generations,” Attorney General Merrick Garland said in a Justice Department release. “Today’s settlement will invest $13.5 million in expanding access to credit services for Black and Hispanic neighborhoods in Charlotte and Winston-Salem that for too long have been denied to them. With this settlement, the Justice Department’s Combating Redlining Initiative has now secured over $122 million in relief for communities across the country. But we recognize how much work we have left to do, and we are not letting up in our efforts to combat discrimination in lending wherever it occurs.”

Under the terms of the settlement, FNB will:

- Invest at least $11.75 million in a loan subsidy fund to increase access to home mortgage, home improvement, and home refinance loans for residents of majority-Black and Hispanic neighborhoods in FNB’s Charlotte and Winston-Salem service areas.

- Spend $1 million on community partnerships to provide services related to credit, consumer financial education, homeownership and foreclosure prevention for residents of predominantly Black and Hispanic neighborhoods in those service areas.

- Spend $750,000 for advertising, outreach, consumer financial education, and credit counseling focused on predominantly Black and Hispanic neighborhoods in those service areas.

- Open three new branches in predominantly Black and Hispanic neighborhoods in Charlotte and Winston-Salem (two in Charlotte and one in Winston-Salem), with at least one mortgage banker assigned to each branch.

- Hire a director of community lending to oversee the continued development of lending in communities of color.

Redlining is the practice of racial steering by real estate agents that direct Black homebuyers and renters to certain neighborhoods or buildings and away from others. It originated in the 1930s with government homeownership programs that were created as part of the New Deal.

The effort and settlement is part of an effort by the Justice Department to combat redlining by banks across the country.

The complaint alleges that between 2017 and 2021, FNB failed to provide mortgage lending services to Black and Hispanic neighborhoods in Charlotte and Winston-Salem and discouraged people seeking credit in those communities from obtaining home loans. Instead, First National Bank’s home mortgage lending was disproportionately focused on white areas in those two cities.

According to the Justice Department, other lenders generated applications in predominantly Black and Hispanic neighborhoods at two and a half times the rate of FNB in Charlotte, and four times the rate of FNB in Winston-Salem.

Additionally, bank branches in both cities were overwhelmingly located in predominantly white neighborhoods. The bank closed its sole branch, located in a predominantly Black and Hispanic neighborhood in Winston-Salem, in 2021.

RELATED CONTENT: Floods Threaten Future Of Princeville, N.C., Oldest Black Town In U.S.